The smart Trick of Paul B Insurance That Nobody is Talking About

Wiki Article

The Single Strategy To Use For Paul B Insurance

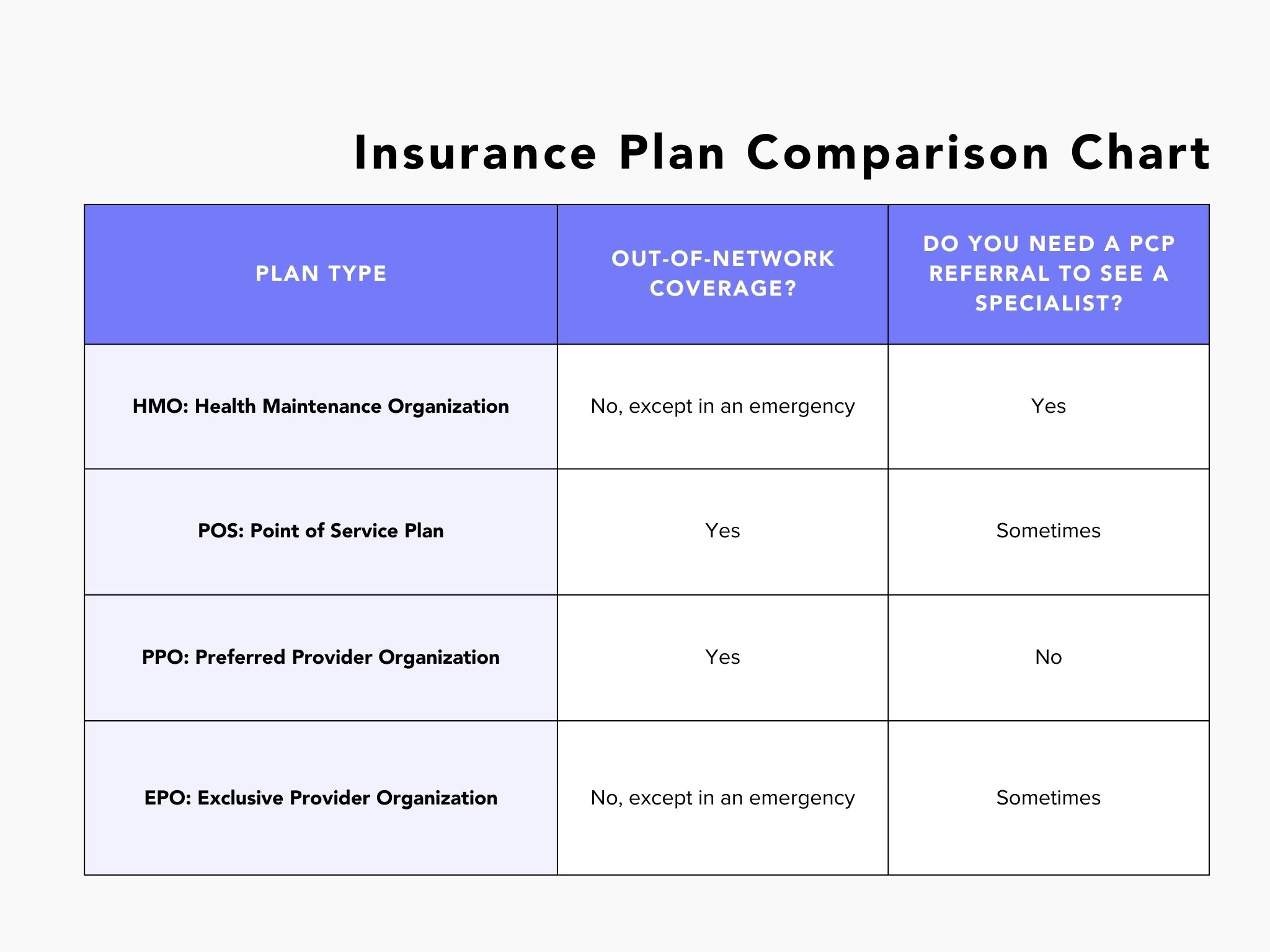

Associated Topics One factor insurance policy concerns can be so confounding is that the health care market is continuously transforming as well as the insurance coverage plans provided by insurance providers are difficult to classify. To put it simply, the lines in between HMOs, PPOs, POSs and other kinds of insurance coverage are usually blurred. Still, recognizing the makeup of various plan kinds will certainly be handy in assessing your alternatives.

PPOs normally provide a broader choice of service providers than HMOs. Costs might resemble or somewhat more than HMOs, and out-of-pocket costs are generally greater and also a lot more complicated than those for HMOs. PPOs permit participants to venture out of the carrier network at their discretion as well as do not call for a recommendation from a medical care physician.

As soon as the deductible quantity is gotten to, added health expenses are covered based on the provisions of the wellness insurance coverage policy. An employee might after that be accountable for 10% of the expenses for treatment received from a PPO network supplier. Deposits made to an HSA are tax-free to the employer and worker, and also money not invested at the end of the year may be rolled over to spend for future clinical expenditures.

Indicators on Paul B Insurance You Should Know

(Company contributions need to be the same for all workers.) Employees would certainly be responsible for the first $5,000 in clinical expenses, but they would certainly each have $3,000 in their individual HSA to pay for medical costs (and also would have much more if they, as well, added to the HSA). If employees or their families tire their $3,000 HSA allocation, they would pay the next $2,000 expense, whereupon the insurance plan would start to pay.

There is no restriction on the quantity of cash a company can add to worker accounts, nonetheless, the accounts might not be funded with staff member income deferrals under a cafeteria strategy. In addition, employers are not allowed to reimburse any kind of component of the balance to workers.

Do you know when one of the most fantastic time of the year is? No, it's not Christmas. We're chatting regarding open enrollment season, infant! That's best! The enchanting season when you reach compare health insurance policy prepares to see which one is right for you! Okay, you got us.

All about Paul B Insurance

When it's time to pick, it's vital to understand what each plan covers, exactly how much it costs, and also where you can utilize it? This stuff can really feel difficult, yet it's easier than it seems. We placed together some sensible knowing steps to aid you feel great regarding your alternatives.

(See what we did there?) Emergency situation treatment is typically the exemption to the guideline. These plans are one of the most prominent for individuals that obtain their wellness insurance coverage with work, with 47% of covered workers registered in a PPO.2 Pro: The Majority Of PPOs have a decent choice of carriers to pick from in your location.

Disadvantage: Higher premiums make PPOs extra expensive than other types of strategies like HMOs. A health care company is a wellness insurance strategy that normally just covers treatment from physicians who benefit (or contract with) that particular strategy.3 Unless there's an emergency, your strategy will certainly not pay for out-of-network care.

The 6-Minute Rule for Paul B Insurance

More like Michael Phelps. It's excellent to recognize that strategies in every category give some types of free preventative treatment, and also some offer complimentary or affordable healthcare services prior to you fulfill your deductible.

Bronze plans have the most affordable monthly costs but the highest possible out-of-pocket expenses. As you function your method up through the Silver, Gold and Platinum groups, you pay much more in premiums, however less in deductibles and also coinsurance. But as we mentioned previously, the extra prices in the Silver group can be reduced if you receive the cost-sharing decreases.

Decreases can reduce your out-of-pocket medical care sets you back a great deal, so obtain with one of our Recommended Regional Providers (ELPs) that can help you find out what you may be eligible for. The table below programs the percentage that the insurer paysand what you payfor protected costs after you satisfy your deductible in each plan category.

Paul B Insurance Fundamentals Explained

Other expenses, typically called "out-of-pocket" expenses, can add up promptly. Things like your deductible, your copay, your coinsurance quantity and also your out-of-pocket optimum can have a huge influence on the total price. Below are some expenditures to hug tabs on: Insurance deductible the amount you pay prior to your insurance business pays anything (besides totally free preventative treatment) Copay a set amount you pay each time for points like doctor brows through or various other solutions Coinsurance - the percentage of health care services you are accountable for paying after you've struck your insurance deductible for the year Out-of-pocket maximum the annual restriction of what you are in charge of paying on your own One of the best means to save cash on medical insurance is to linked here make use of visit site a high-deductible health insurance (HDHP), especially if you do not expect to frequently use medical solutions.

When picking your health and wellness insurance policy strategy, do not fail to remember regarding medical care cost-sharing programs. These work practically like the other health insurance policy programs we defined already, yet technically they're not a type of insurance. Allow us to explain. Wellness cost-sharing programs still have month-to-month premiums you pay and also defined insurance coverage terms.

If you're attempting the do it yourself course and have any kind of sticking around concerns regarding wellness insurance coverage plans, the experts are the ones to ask. And also they'll do even more than simply address your questionsthey'll likewise discover you the best rate! Or perhaps you would certainly such as a method to integrate obtaining terrific health care insurance coverage with the chance to help others in a time of requirement.

Paul B Insurance Fundamentals Explained

Our you can look here relied on companion Christian Medical care Ministries (CHM) can assist you figure out your choices. CHM aids households share healthcare costs like clinical tests, maternity, a hospital stay and also surgery. Countless people in all 50 states have utilized CHM to cover their health care requires. Plus, they're a Ramsey, Relied on companion, so you know they'll cover the clinical costs they're expected to as well as recognize your coverage.

Trick Question 2 One of the things healthcare reform has carried out in the united state (under the Affordable Treatment Act) is to present even more standardization to insurance coverage plan benefits. Prior to such standardization, the benefits offered diverse considerably from plan to strategy. Some plans covered prescriptions, others did not.

Report this wiki page